YIELDMAX WEEKLY PAYERS YIELD CHASER SPECIAL 3/17/2025 -- An Analysis of YieldMax Weekly Payers by Current Yield and Since Inception

Always take current yield with a grain (or a river) of salt

As always, please read our disclaimer.

The following stocks are sorted in descending order of greatest “current yield.”’

As we’ve stated before in other posts, we’re not big fans of current yield because current yield never tells the whole story.

However, the “YieldMax Yield Chaser Special” series of postings continue to be our most popular.

So… we will keep doing it… but read at your own risk.

We won’t do the whole long form explanation of why current yields are risky — we’ve done that elsewhere.

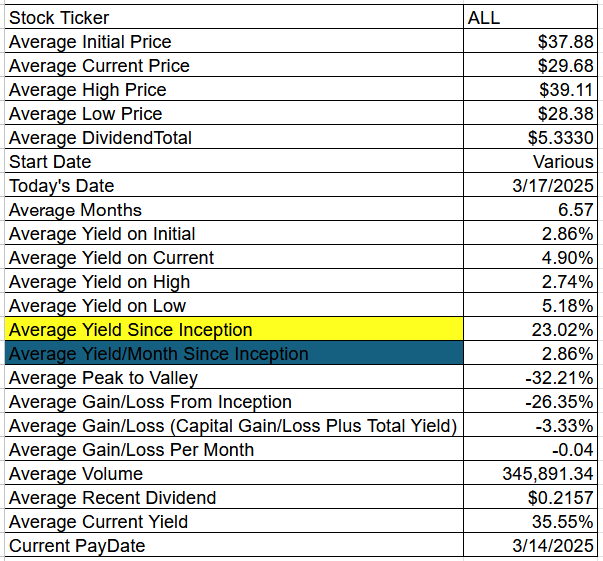

But here is some kind of interesting data from these 7 YieldMax weekly payers.

For all of the entries below, do make sure to look at the full picture (the first paragraph of each entry) before riding the rapids of “The River of Current Yield.”

Fair warning.

Occasionally we may hold positions in some of these stocks.

All dividends are calculated based on the “Ex-EFF Date.”

[1] YieldMax Crypto Industry & Tech Port Opt Inc ETF [LFGY]

LFGY had total dividends of $4.5630 from 1/17/2025 to 3/17/2025. During that time frame it had a starting price of $54.42, a high price of $55.11, a low price of $35.11, and a 3/17/2025 price of $38.26. This means that it had a yield of 8.38%, or an average monthly yield of 4.19%. The peak-to-valley is -36.29%. The capital gains were -29.69%. The overall gain/loss (cap gains + yield) is -21.31%, or a gain/loss per month of -10.66%. The average volume since inception was 114,310.

LFGY received a recent dividend of $0.4173 on 3/14/2025. This means the current yield ($0.4173 / $38.26 * weeks/months per year paid) is 56.72%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/LFGY/dividend-history

[2] YieldMax Magnificent 7 Fund of Option Income ETFs [YMAG]

YMAG had total dividends of $8.4328 from 2/2/2024 to 3/17/2025. During that time frame it had a starting price of $20.30, a high price of $21.91, a low price of $15.05, and a 3/17/2025 price of $15.42. This means that it had a yield of 41.54%, or an average monthly yield of 3.08%. The peak-to-valley is -31.31%. The capital gains were -24.04%. The overall gain/loss (cap gains + yield) is 17.50%, or a gain/loss per month of 1.30%. The average volume since inception was 405,128.

YMAG received a recent dividend of $0.1445 on 3/14/2025. This means the current yield ($0.1445 / $15.42 * weeks/months per year paid) is 48.73%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/YMAG/dividend-history

[3] YieldMax Universe Fund of Option Income ETFs [YMAX]

YMAX had total dividends of $9.2456 from 1/19/2024 to 3/17/2025. During that time frame it had a starting price of $20.12, a high price of $21.94, a low price of $13.51, and a 3/17/2025 price of $14.13. This means that it had a yield of 45.95%, or an average monthly yield of 3.32%. The peak-to-valley is -38.42%. The capital gains were -29.77%. The overall gain/loss (cap gains + yield) is 16.18%, or a gain/loss per month of 1.17%. The average volume since inception was 811,337.

YMAX received a recent dividend of $0.1002 on 3/14/2025. This means the current yield ($0.1002 / $14.13 * weeks/months per year paid) is 36.87%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/YMAX/dividend-history

[4] YieldMax AI & Tech Portfolio Option Income ETF [GPTY]

GPTY had total dividends of $1.8594 from 1/24/2025 to 3/17/2025. During that time frame it had a starting price of $49.72, a high price of $50.43, a low price of $39.38, and a 3/17/2025 price of $41.48. This means that it had a yield of 3.74%, or an average monthly yield of 2.21%. The peak-to-valley is -21.91%. The capital gains were -16.57%. The overall gain/loss (cap gains + yield) is -12.83%, or a gain/loss per month of -7.59%. The average volume since inception was 34,552.

GPTY received a recent dividend of $0.2823 on 3/14/2025. This means the current yield ($0.2823 / $41.48 * weeks/months per year paid) is 35.39%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/GPTY/dividend-history

[5] YieldMax Nasdaq 100 0DTE Covered Call Strategy ETF [QDTY]

QDTY had total dividends of $0.7271 from 2/14/2025 to 3/17/2025. During that time frame it had a starting price of $50.80, a high price of $52.55, a low price of $44.31, and a 3/17/2025 price of $45.55. This means that it had a yield of 1.43%, or an average monthly yield of 1.30%. The peak-to-valley is -15.68%. The capital gains were -10.33%. The overall gain/loss (cap gains + yield) is -8.90%, or a gain/loss per month of -8.10%. The average volume since inception was 11,995.

QDTY received a recent dividend of $0.2460 on 3/14/2025. This means the current yield ($0.2460 / $45.55 * weeks/months per year paid) is 28.08%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/QDTY/dividend-history

[6] YieldMax S&P 500 0DTE Covered Call Strategy ETF [SDTY]

SDTY had total dividends of $0.8081 from 2/7/2025 to 3/17/2025. During that time frame it had a starting price of $49.82, a high price of $51.29, a low price of $45.12, and a 3/17/2025 price of $46.30. This means that it had a yield of 1.62%, or an average monthly yield of 1.22%. The peak-to-valley is -12.03%. The capital gains were -7.07%. The overall gain/loss (cap gains + yield) is -5.44%, or a gain/loss per month of -4.10%. The average volume since inception was 20,381.

SDTY received a recent dividend of $0.2174 on 3/14/2025. This means the current yield ($0.2174 / $46.30 * weeks/months per year paid) is 24.42%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/SDTY/dividend-history

[7] YieldMax Ultra Option Income Strategy ETF [ULTY]

ULTY had total dividends of $11.6953 from 3/1/2024 to 3/17/2025. During that time frame it had a starting price of $20.00, a high price of $20.55, a low price of $6.20, and a 3/17/2025 price of $6.61. This means that it had a yield of 58.48%, or an average monthly yield of 4.67%. The peak-to-valley is -69.83%. The capital gains were -66.95%. The overall gain/loss (cap gains + yield) is -8.47%, or a gain/loss per month of -0.68%. The average volume since inception was 1,023,537.

ULTY received a recent dividend of $0.1025 on 3/14/2025. This means the current yield ($0.1025 / $6.61 * weeks/months per year paid) is 18.61%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/ULTY/dividend-history