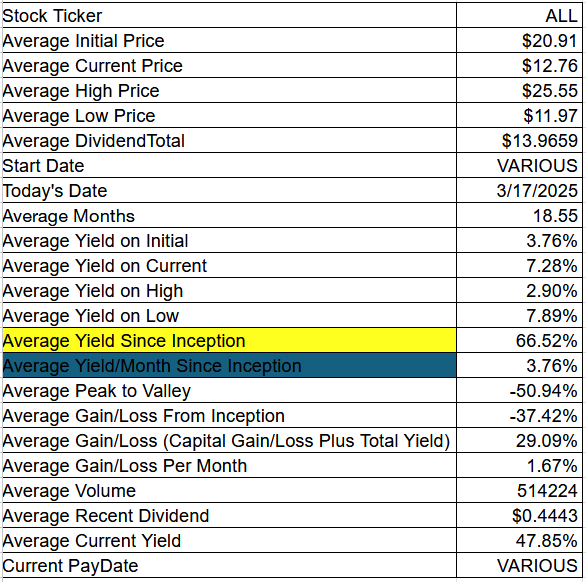

YIELDMAX "OLD DOGS" YIELD CHASER SPECIAL 3/17/2025 -- An Analysis of YieldMax Dividend Payers Active Greater Than One Year

Always take current yield with a grain (or a river) of salt

As always, please read our disclaimer.

The following stocks are sorted in descending order of greatest “current yield.”’

As we’ve stated before in other posts, we’re not big fans of current yield because current yield never tells the whole story.

However, the “YieldMax Yield Chaser Special” series of postings continue to be our most popular.

So… we will keep doing them… but read at your own risk.

We won’t do the whole long form explanation of why current yields are risky — we’ve done that elsewhere.

But here is some kind of interesting data from these 22 YieldMax dividend payers that have been around for more than a year.

For all of the entries below, do make sure to look at the full picture (the first paragraph of each entry) before riding the rapids of “The River of Current Yield.”

Fair warning.

Occasionally we may hold positions in some of these stocks.

All dividends are calculated based on the “Ex-EFF Date.”

[1] YieldMax NVDA Option Income Strategy ETF [NVDY]

NVDY had total dividends of $27.9186 from 5/12/2023 to 3/17/2025. It has been active for 22.16 months. During that time frame it had a starting price of $19.83, a high price of $31.77, a low price of $15.56, and a 3/17/2025 price of $17.31. This means that it had a yield of 140.79%, or an average monthly yield of 6.35%. The peak-to-valley is -51.02%. The capital gains were -12.71%. The overall gain/loss (cap gains + yield) is 128.08%, or a gain/loss per month of 5.78%. The average volume since inception was 1,080,349.

NVDY received a recent dividend of $1.6118 on 2/28/2025. This means the current yield ($1.6118 / $17.31 * weeks/months per year paid) is 111.74%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/NVDY/dividend-history

[2] YieldMax COIN Option Income Strategy ETF [CONY]

CONY had total dividends of $27.5255 from 8/18/2023 to 3/17/2025. It has been active for 18.89 months. During that time frame it had a starting price of $18.42, a high price of $30.18, a low price of $7.85, and a 3/17/2025 price of $8.39. This means that it had a yield of 149.43%, or an average monthly yield of 7.91%. The peak-to-valley is -73.99%. The capital gains were -54.45%. The overall gain/loss (cap gains + yield) is 94.98%, or a gain/loss per month of 5.03%. The average volume since inception was 2,060,875.

CONY received a recent dividend of $0.5989 on 3/7/2025. This means the current yield ($0.5989 / $8.39 * weeks/months per year paid) is 85.66%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/CONY/dividend-history

[3] YieldMax TSLA Option Income Strategy ETF [TSLY]

TSLY had total dividends of $31.2862 from 11/25/2022 to 3/17/2025. It has been active for 27.66 months. During that time frame it had a starting price of $40.88, a high price of $43.53, a low price of $7.47, and a 3/17/2025 price of $8.24. This means that it had a yield of 76.53%, or an average monthly yield of 2.77%. The peak-to-valley is -82.84%. The capital gains were -79.84%. The overall gain/loss (cap gains + yield) is -3.31%, or a gain/loss per month of -0.12%. The average volume since inception was 2,101,081.

TSLY received a recent dividend of $0.5793 on 2/21/2025. This means the current yield ($0.5793 / $8.24 * weeks/months per year paid) is 84.36%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/TSLY/dividend-history

[4] YieldMax MRNA Option Income Strategy ETF [MRNY]

MRNY had total dividends of $10.5565 from 10/27/2023 to 3/17/2025. It has been active for 16.59 months. During that time frame it had a starting price of $18.33, a high price of $26.00, a low price of $3.04, and a 3/17/2025 price of $3.46. This means that it had a yield of 57.59%, or an average monthly yield of 3.47%. The peak-to-valley is -88.31%. The capital gains were -81.12%. The overall gain/loss (cap gains + yield) is -23.53%, or a gain/loss per month of -1.42%. The average volume since inception was 344,314.

MRNY received a recent dividend of $0.2308 on 2/28/2025. This means the current yield ($0.2308 / $3.46 * weeks/months per year paid) is 80.05%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/MRNY/dividend-history

[5] YieldMax MSTR Option Income Strategy ETF [MSTY]

MSTY had total dividends of $33.1889 from 2/23/2024 to 3/17/2025. It has been active for 12.72 months. During that time frame it had a starting price of $21.60, a high price of $46.50, a low price of $17.88, and a 3/17/2025 price of $20.73. This means that it had a yield of 153.65%, or an average monthly yield of 12.08%. The peak-to-valley is -61.55%. The capital gains were -4.03%. The overall gain/loss (cap gains + yield) is 149.62%, or a gain/loss per month of 11.76%. The average volume since inception was 2,178,540.

MSTY received a recent dividend of $1.3775 on 3/14/2025. This means the current yield ($1.3775 / $20.73 * weeks/months per year paid) is 79.74%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/MSTY/dividend-history

[6] YieldMax AI Option Income Strategy ETF [AIYY]

AIYY had total dividends of $9.4607 from 12/1/2023 to 3/17/2025. It has been active for 15.53 months. During that time frame it had a starting price of $20.76, a high price of $21.69, a low price of $4.66, and a 3/17/2025 price of $4.91. This means that it had a yield of 45.57%, or an average monthly yield of 2.94%. The peak-to-valley is -78.52%. The capital gains were -76.35%. The overall gain/loss (cap gains + yield) is -30.78%, or a gain/loss per month of -1.98%. The average volume since inception was 206,738.

AIYY received a recent dividend of $0.3221 on 3/14/2025. This means the current yield ($0.3221 / $4.91 * weeks/months per year paid) is 78.72%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/AIYY/dividend-history

[7] YieldMax Innovation Option Income Strategy ETF [OARK]

OARK had total dividends of $12.1705 from 11/25/2022 to 3/17/2025. It has been active for 27.66 months. During that time frame it had a starting price of $20.02, a high price of $21.26, a low price of $7.80, and a 3/17/2025 price of $8.32. This means that it had a yield of 60.79%, or an average monthly yield of 2.20%. The peak-to-valley is -63.31%. The capital gains were -58.44%. The overall gain/loss (cap gains + yield) is 2.35%, or a gain/loss per month of 0.08%. The average volume since inception was 102,129.

OARK received a recent dividend of $0.4269 on 2/21/2025. This means the current yield ($0.4269 / $8.32 * weeks/months per year paid) is 61.57%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/OARK/dividend-history

[8] YieldMax SQ Option Income Strategy ETF [SQY]

SQY had total dividends of $15.6341 from 10/13/2023 to 3/17/2025. It has been active for 17.13 months. During that time frame it had a starting price of $18.96, a high price of $26.70, a low price of $10.58, and a 3/17/2025 price of $11.42. This means that it had a yield of 82.46%, or an average monthly yield of 4.81%. The peak-to-valley is -60.37%. The capital gains were -39.77%. The overall gain/loss (cap gains + yield) is 42.69%, or a gain/loss per month of 2.49%. The average volume since inception was 71,058.

SQY received a recent dividend of $0.5014 on 3/14/2025. This means the current yield ($0.5014 / $11.42 * weeks/months per year paid) is 52.69%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/SQY/dividend-history

[9] YieldMax Magnificent 7 Fund of Option Income ETFs [YMAG]

YMAG had total dividends of $8.4328 from 2/2/2024 to 3/17/2025. It has been active for 13.49 months. During that time frame it had a starting price of $20.30, a high price of $21.91, a low price of $15.05, and a 3/17/2025 price of $15.42. This means that it had a yield of 41.54%, or an average monthly yield of 3.08%. The peak-to-valley is -31.31%. The capital gains were -24.04%. The overall gain/loss (cap gains + yield) is 17.50%, or a gain/loss per month of 1.30%. The average volume since inception was 405,128.

YMAG received a recent dividend of $0.1445 on 3/14/2025. This means the current yield ($0.1445 / $15.42 * weeks/months per year paid) is 48.73%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/YMAG/dividend-history

[10] YieldMax AMD Option Income Strategy ETF [AMDY]

AMDY had total dividends of $13.6543 from 9/22/2023 to 3/17/2025. It has been active for 17.76 months. During that time frame it had a starting price of $18.96, a high price of $24.28, a low price of $7.48, and a 3/17/2025 price of $8.15. This means that it had a yield of 72.02%, or an average monthly yield of 4.06%. The peak-to-valley is -69.19%. The capital gains were -57.01%. The overall gain/loss (cap gains + yield) is 15.00%, or a gain/loss per month of 0.84%. The average volume since inception was 282,438.

AMDY received a recent dividend of $0.2533 on 3/7/2025. This means the current yield ($0.2533 / $8.15 * weeks/months per year paid) is 37.30%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/AMDY/dividend-history

[11] YieldMax Universe Fund of Option Income ETFs [YMAX]

YMAX had total dividends of $9.2456 from 1/19/2024 to 3/17/2025. It has been active for 13.85 months. During that time frame it had a starting price of $20.12, a high price of $21.94, a low price of $13.51, and a 3/17/2025 price of $14.13. This means that it had a yield of 45.95%, or an average monthly yield of 3.32%. The peak-to-valley is -38.42%. The capital gains were -29.77%. The overall gain/loss (cap gains + yield) is 16.18%, or a gain/loss per month of 1.17%. The average volume since inception was 811,337.

YMAX received a recent dividend of $0.1002 on 3/14/2025. This means the current yield ($0.1002 / $14.13 * weeks/months per year paid) is 36.87%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/YMAX/dividend-history

[12] YieldMax GOOGL Option Income Strategy ETF [GOOY]

GOOY had total dividends of $7.6109 from 7/28/2023 to 3/17/2025. It has been active for 19.56 months. During that time frame it had a starting price of $20.50, a high price of $20.83, a low price of $12.52, and a 3/17/2025 price of $12.81. This means that it had a yield of 37.13%, or an average monthly yield of 1.90%. The peak-to-valley is -39.89%. The capital gains were -37.51%. The overall gain/loss (cap gains + yield) is -0.39%, or a gain/loss per month of -0.02%. The average volume since inception was 63,325.

GOOY received a recent dividend of $0.3877 on 2/21/2025. This means the current yield ($0.3877 / $12.81 * weeks/months per year paid) is 36.32%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/GOOY/dividend-history

[13] YieldMax PYPL Option Income Strategy ETF [PYPY]

PYPY had total dividends of $11.3285 from 9/29/2023 to 3/17/2025. It has been active for 17.53 months. During that time frame it had a starting price of $19.94, a high price of $21.15, a low price of $13.20, and a 3/17/2025 price of $13.78. This means that it had a yield of 56.81%, or an average monthly yield of 3.24%. The peak-to-valley is -37.59%. The capital gains were -30.89%. The overall gain/loss (cap gains + yield) is 25.92%, or a gain/loss per month of 1.48%. The average volume since inception was 42,978.

PYPY received a recent dividend of $0.3773 on 3/7/2025. This means the current yield ($0.3773 / $13.78 * weeks/months per year paid) is 32.86%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/PYPY/dividend-history

[14] YieldMax META Option Income Strategy ETF [FBY]

FBY had total dividends of $13.6359 from 7/28/2023 to 3/17/2025. It has been active for 19.56 months. During that time frame it had a starting price of $20.63, a high price of $24.49, a low price of $16.55, and a 3/17/2025 price of $17.57. This means that it had a yield of 66.10%, or an average monthly yield of 3.38%. The peak-to-valley is -32.42%. The capital gains were -14.83%. The overall gain/loss (cap gains + yield) is 51.26%, or a gain/loss per month of 2.62%. The average volume since inception was 93,123.

FBY received a recent dividend of $0.4767 on 2/28/2025. This means the current yield ($0.4767 / $17.57 * weeks/months per year paid) is 32.56%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/FBY/dividend-history

[15] YieldMax AMZN Option Income Strategy ETF [AMZY]

AMZY had total dividends of $12.4956 from 7/28/2023 to 3/17/2025. It has been active for 19.56 months. During that time frame it had a starting price of $20.46, a high price of $24.10, a low price of $15.90, and a 3/17/2025 price of $16.24. This means that it had a yield of 61.07%, or an average monthly yield of 3.12%. The peak-to-valley is -34.02%. The capital gains were -20.63%. The overall gain/loss (cap gains + yield) is 40.45%, or a gain/loss per month of 2.07%. The average volume since inception was 175,703.

AMZY received a recent dividend of $0.4177 on 3/14/2025. This means the current yield ($0.4177 / $16.24 * weeks/months per year paid) is 30.86%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/AMZY/dividend-history

[16] YieldMax NFLX Option Income Strategy ETF [NFLY]

NFLY had total dividends of $13.3089 from 8/11/2023 to 3/17/2025. It has been active for 19.2 months. During that time frame it had a starting price of $19.31, a high price of $20.36, a low price of $14.98, and a 3/17/2025 price of $16.95. This means that it had a yield of 68.92%, or an average monthly yield of 3.59%. The peak-to-valley is -26.42%. The capital gains were -12.22%. The overall gain/loss (cap gains + yield) is 56.70%, or a gain/loss per month of 2.95%. The average volume since inception was 80,977.

NFLY received a recent dividend of $0.4008 on 3/7/2025. This means the current yield ($0.4008 / $16.95 * weeks/months per year paid) is 28.38%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/NFLY/dividend-history

[17] YieldMax AAPL Option Income Strategy ETF [APLY]

APLY had total dividends of $8.3101 from 4/21/2023 to 3/17/2025. It has been active for 22.79 months. During that time frame it had a starting price of $20.10, a high price of $23.02, a low price of $14.29, and a 3/17/2025 price of $14.68. This means that it had a yield of 41.34%, or an average monthly yield of 1.81%. The peak-to-valley is -37.92%. The capital gains were -26.97%. The overall gain/loss (cap gains + yield) is 14.38%, or a gain/loss per month of 0.63%. The average volume since inception was 67,752.

APLY received a recent dividend of $0.3440 on 3/14/2025. This means the current yield ($0.3440 / $14.68 * weeks/months per year paid) is 28.12%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/APLY/dividend-history

[18] YieldMax DIS Option Income Strategy ETF [DISO]

DISO had total dividends of $8.7001 from 8/25/2023 to 3/17/2025. It has been active for 18.66 months. During that time frame it had a starting price of $20.16, a high price of $22.69, a low price of $13.82, and a 3/17/2025 price of $14.25. This means that it had a yield of 43.16%, or an average monthly yield of 2.31%. The peak-to-valley is -39.09%. The capital gains were -29.32%. The overall gain/loss (cap gains + yield) is 13.84%, or a gain/loss per month of 0.74%. The average volume since inception was 14,713.

DISO received a recent dividend of $0.2879 on 3/14/2025. This means the current yield ($0.2879 / $14.25 * weeks/months per year paid) is 24.24%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/DISO/dividend-history

[19] YieldMax JPM Option Income Strategy ETF [JPMO]

JPMO had total dividends of $6.8146 from 9/15/2023 to 3/17/2025. It has been active for 18.07 months. During that time frame it had a starting price of $20.36, a high price of $22.30, a low price of $15.73, and a 3/17/2025 price of $16.48. This means that it had a yield of 33.47%, or an average monthly yield of 1.85%. The peak-to-valley is -29.46%. The capital gains were -19.06%. The overall gain/loss (cap gains + yield) is 14.41%, or a gain/loss per month of 0.80%. The average volume since inception was 18,812.

JPMO received a recent dividend of $0.2951 on 2/28/2025. This means the current yield ($0.2951 / $16.48 * weeks/months per year paid) is 21.49%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/JPMO/dividend-history

[20] YieldMax MSFT Option Income Strategy ETF [MSFO]

MSFO had total dividends of $8.8418 from 8/25/2023 to 3/17/2025. It has been active for 18.66 months. During that time frame it had a starting price of $20.18, a high price of $23.48, a low price of $15.54, and a 3/17/2025 price of $16.14. This means that it had a yield of 43.81%, or an average monthly yield of 2.35%. The peak-to-valley is -33.82%. The capital gains were -20.02%. The overall gain/loss (cap gains + yield) is 23.79%, or a gain/loss per month of 1.28%. The average volume since inception was 53,208.

MSFO received a recent dividend of $0.2845 on 3/7/2025. This means the current yield ($0.2845 / $16.14 * weeks/months per year paid) is 21.15%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/MSFO/dividend-history

[21] YieldMax XOM Option Income Strategy ETF [XOMO]

XOMO had total dividends of $5.4354 from 9/1/2023 to 3/17/2025. It has been active for 18.53 months. During that time frame it had a starting price of $20.28, a high price of $23.38, a low price of $13.69, and a 3/17/2025 price of $14.72. This means that it had a yield of 26.80%, or an average monthly yield of 1.45%. The peak-to-valley is -41.45%. The capital gains were -27.42%. The overall gain/loss (cap gains + yield) is -0.61%, or a gain/loss per month of -0.03%. The average volume since inception was 34,035.

XOMO received a recent dividend of $0.2541 on 2/21/2025. This means the current yield ($0.2541 / $14.72 * weeks/months per year paid) is 20.71%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/XOMO/dividend-history

[22] YieldMax Ultra Option Income Strategy ETF [ULTY]

ULTY had total dividends of $11.6953 from 3/1/2024 to 3/17/2025. It has been active for 12.53 months. During that time frame it had a starting price of $20.00, a high price of $20.55, a low price of $6.20, and a 3/17/2025 price of $6.61. This means that it had a yield of 58.48%, or an average monthly yield of 4.67%. The peak-to-valley is -69.83%. The capital gains were -66.95%. The overall gain/loss (cap gains + yield) is -8.47%, or a gain/loss per month of -0.68%. The average volume since inception was 1,024,311.

ULTY received a recent dividend of $0.1025 on 3/14/2025. This means the current yield ($0.1025 / $6.61 * weeks/months per year paid) is 18.61%.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/ULTY/dividend-history