WEEKLY PAYERS -- YIELDMAX YIELD CHASER SPECIAL 5/6/2025 -- An Analysis of YieldMax Weekly Payers by Current Yield and Since Inception

Always take current yield with a grain (or a river) of salt

As always, please read our disclaimer.

In addition to the master yield chaser file — a subscriber made a request to break things down into “old dogs” (YieldMax products 12 months or older), the “new kids” (less than 12 months in existence), and “weekly payers” (YieldMax products that pay weekly—this post).

We apologize if some of this seems redundant — but it actually is a useful way to break down YieldMax’s 46 products into more manageable chunks.

If you want to ignore this and just use the master file, you can.

For those who like to see a bit more performance history before investing, use the “Old Dogs” post.

For those willing to take a flyer on something with less performance history, use the “New Kids” post instead.

For those looking for “weekly payers” — this is the post for you!

Enjoy!

The following stocks are sorted in descending order of greatest “current yield.”’

As we’ve stated before in other posts, we’re not big fans of current yield because current yield never tells the whole story.

However, the “YieldMax Yield Chaser Special” series of postings continue to be our most popular.

So… we will keep doing them… but read at your own risk.

We won’t do the whole long form explanation of why current yields are risky — we’ve done that elsewhere.

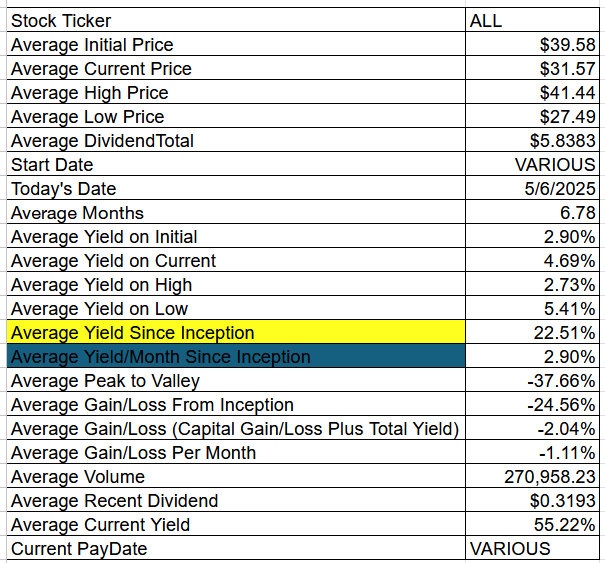

But here is some kind of interesting data from these 9 YieldMax weekly payers.

For all of the entries below, do make sure to look at the full picture (the first paragraph of each entry) before riding the rapids of “The River of Current Yield.”

Fair warning.

Occasionally we may hold positions in some of these stocks.

All dividends are calculated based on the “Ex-EFF Date.”

[1] YieldMax Ultra Option Income Strategy ETF [ULTY]

ULTY had total dividends of $12.3278 from 2/29/2024 to 5/6/2025. It has been active for 14.23 months. During that time frame it had a starting price of $19.35, a high price of $20.55, a low price of $5.23, and a 5/6/2025 price of $5.94. This means that it had a yield of 63.71%, or an average monthly yield of 4.48%. The peak-to-valley is -74.55%. The capital gains were -69.30%. The overall gain/loss (cap gains + yield) is -5.59%, or a gain/loss per month of -0.39%. The average volume since inception was 1,083,076.

ULTY received a recent dividend of $0.0936 on 4/25/2025. This means the current yield ($0.0936 / $5.94 * weeks/months per year paid) is 81.94%.

[2] YieldMax Universe Fund of Option Income ETFs [YMAX]

YMAX had total dividends of $10.2812 from 1/17/2024 to 5/6/2025. It has been active for 15.62 months. During that time frame it had a starting price of $19.90, a high price of $21.94, a low price of $11.21, and a 5/6/2025 price of $13.10. This means that it had a yield of 51.66%, or an average monthly yield of 3.31%. The peak-to-valley is -48.91%. The capital gains were -34.17%. The overall gain/loss (cap gains + yield) is 17.49%, or a gain/loss per month of 1.12%. The average volume since inception was 859,471.

YMAX received a recent dividend of $0.1744 on 5/2/2025. This means the current yield ($0.1744 / $13.10 * weeks/months per year paid) is 69.23%.

[3] YieldMax Semiconductor Portfolio Option Income ETF [CHPY]

CHPY had total dividends of $1.3310 from 4/3/2025 to 5/6/2025. It has been active for 1.1 months. During that time frame it had a starting price of $45.65, a high price of $49.15, a low price of $40.40, and a 5/6/2025 price of $48.31. This means that it had a yield of 2.92%, or an average monthly yield of 2.65%. The peak-to-valley is -17.80%. The capital gains were 5.83%. The overall gain/loss (cap gains + yield) is 8.74%, or a gain/loss per month of 7.96%. The average volume since inception was 5,311.

CHPY received a recent dividend of $0.6229 on 4/25/2025. This means the current yield ($0.6229 / $48.31 * weeks/months per year paid) is 67.05%.

[4] YieldMax Crypto Industry & Tech Port Opt Inc ETF [LFGY]

LFGY had total dividends of $7.6577 from 1/14/2025 to 5/6/2025. It has been active for 3.72 months. During that time frame it had a starting price of $51.25, a high price of $55.11, a low price of $30.09, and a 5/6/2025 price of $36.85. This means that it had a yield of 14.94%, or an average monthly yield of 4.01%. The peak-to-valley is -45.40%. The capital gains were -28.10%. The overall gain/loss (cap gains + yield) is -13.16%, or a gain/loss per month of -3.53%. The average volume since inception was 49,607.

LFGY received a recent dividend of $0.4721 on 5/2/2025. This means the current yield ($0.4721 / $36.85 * weeks/months per year paid) is 66.62%.

[5] YieldMax Russell 2000 0DTE Covered Call Strat ETF [RDTY]

RDTY had total dividends of $2.6182 from 3/6/2025 to 5/6/2025. It has been active for 2 months. During that time frame it had a starting price of $49.21, a high price of $50.07, a low price of $39.35, and a 5/6/2025 price of $43.26. This means that it had a yield of 5.32%, or an average monthly yield of 2.66%. The peak-to-valley is -21.41%. The capital gains were -12.09%. The overall gain/loss (cap gains + yield) is -6.77%, or a gain/loss per month of -3.39%. The average volume since inception was 6,158.

RDTY received a recent dividend of $0.4696 on 4/25/2025. This means the current yield ($0.4696 / $43.26 * weeks/months per year paid) is 56.45%.

[6] YieldMax Nasdaq 100 0DTE Covered Call Strategy ETF [QDTY]

QDTY had total dividends of $2.7856 from 2/13/2025 to 5/6/2025. It has been active for 2.76 months. During that time frame it had a starting price of $50.61, a high price of $52.55, a low price of $36.76, and a 5/6/2025 price of $39.94. This means that it had a yield of 5.50%, or an average monthly yield of 2.00%. The peak-to-valley is -30.05%. The capital gains were -21.08%. The overall gain/loss (cap gains + yield) is -15.58%, or a gain/loss per month of -5.65%. The average volume since inception was 12,615.

QDTY received a recent dividend of $0.3362 on 4/25/2025. This means the current yield ($0.3362 / $39.94 * weeks/months per year paid) is 43.77%.

[7] YieldMax S&P 500 0DTE Covered Call Strategy ETF [SDTY]

SDTY had total dividends of $2.7601 from 2/6/2025 to 5/6/2025. It has been active for 3 months. During that time frame it had a starting price of $50.29, a high price of $51.29, a low price of $38.59, and a 5/6/2025 price of $41.99. This means that it had a yield of 5.49%, or an average monthly yield of 1.83%. The peak-to-valley is -24.76%. The capital gains were -16.50%. The overall gain/loss (cap gains + yield) is -11.02%, or a gain/loss per month of -3.67%. The average volume since inception was 15,510.

SDTY received a recent dividend of $0.3110 on 4/25/2025. This means the current yield ($0.3110 / $41.99 * weeks/months per year paid) is 38.51%.

[8] YieldMax AI & Tech Portfolio Option Income ETF [GPTY]

GPTY had total dividends of $3.6992 from 1/23/2025 to 5/6/2025. It has been active for 3.43 months. During that time frame it had a starting price of $50.09, a high price of $50.43, a low price of $32.92, and a 5/6/2025 price of $39.85. This means that it had a yield of 7.39%, or an average monthly yield of 2.15%. The peak-to-valley is -34.72%. The capital gains were -20.44%. The overall gain/loss (cap gains + yield) is -13.06%, or a gain/loss per month of -3.81%. The average volume since inception was 6,638.

GPTY received a recent dividend of $0.2926 on 4/25/2025. This means the current yield ($0.2926 / $39.85 * weeks/months per year paid) is 38.18%.

[9] YieldMax Magnificent 7 Fund of Option Income ETFs [YMAG]

YMAG had total dividends of $9.0800 from 1/30/2024 to 5/6/2025. It has been active for 15.2 months. During that time frame it had a starting price of $19.89, a high price of $21.91, a low price of $12.85, and a 5/6/2025 price of $14.89. This means that it had a yield of 45.67%, or an average monthly yield of 3.01%. The peak-to-valley is -41.35%. The capital gains were -25.14%. The overall gain/loss (cap gains + yield) is 20.53%, or a gain/loss per month of 1.35%. The average volume since inception was 400,238.

YMAG received a recent dividend of $0.1010 on 4/25/2025. This means the current yield ($0.1010 / $14.89 * weeks/months per year paid) is 35.27%.