WEEKLY PAYERS -- Yield + Capital Gain Analysis 12/23/2025

A more realistic view of current yield trends

As always, please read our disclaimer. Important!

As mentioned in previous weeks, YieldMax is almost exclusively weekly-pay at this point.

So we handle them in a separate post — as 100+ weekly payers ends up being too long for an e-mail.

You can see the most recent YieldMax post here:

The Current Yield Conundrum

We also recently wrote a long post about why “current yield” is a problematic metric.

We won’t go into all of that here, but do consider the following article…

…as quoted here in its entirety.

When looking at the weekly-payer space in particular, the information in that article is really useful to know. Do check it out.

The Weekly Payer Landscape

This week GraniteShares YieldBoost added two new products: YBST (#29) and YBTY (#19).

So the current landscape of weekly payers now is dominated by YieldMax (54), then Roundhill (31), Granite Shares YieldBoost (24), Rex Shares (10), and Nicholas Wealth’s XFunds (2).

We’ve also covered each of those companies’ products individually in the posts below:

There are a few weekly payers we don’t cover for a variety of reasons, but overall, there are now well over 120+ weekly payers in the marketplace… and the marketplace just keeps growing.

People like to get paid every week. Who knew?

Please note due to some short time frames here, positions in the rankings can be skewed a bit — sometimes that is good for newer ETFs — but sometimes not.

ETFs with short time frames will even out in the rankings as they accumulate additional months of performance.

We list them all… even the hyper-new ones… because that’s just what we do.

The ETFs below are listed in descending order of “yield + capital gain.”

As mentioned in the article…

…“yield + capital gain” is a much more realistic way to look at these high-yield ETFs—ETFs that give you a high current yield number, and then their long-term results look nothing like that at all.

Do take a look at the bold yield + capital gain section in each analysis below. I think that tells a more realistic story.

Fair warning.

Enjoy!

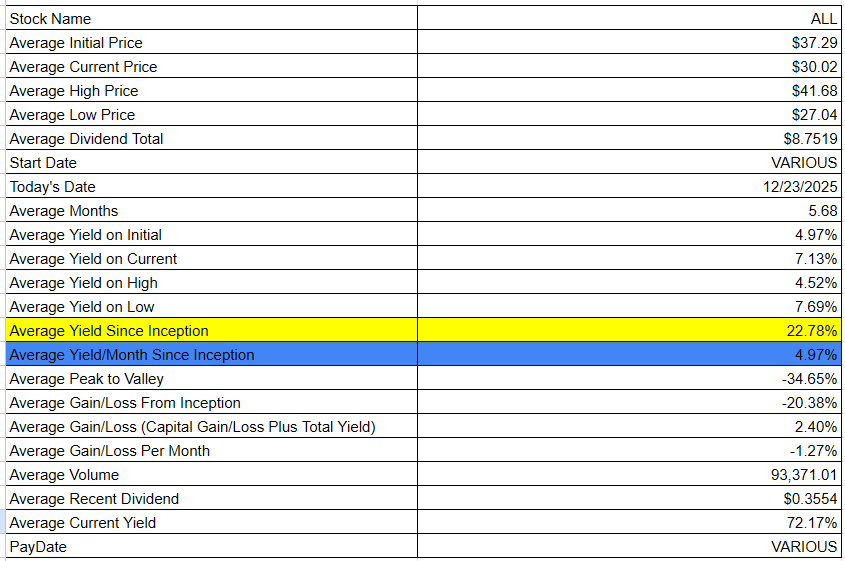

Averages Table

Here’s a “table of averages” for the issues below; not definitive, but kind of interesting:

Please note some of the stocks below may have had “special” dividends, high one-off payments, or spinoff payments which will not repeat.

All dividends are calculated based on the “Ex-EFF Date.”

Individual Stock Analysis (67 entries)

[1] Roundhill Gold Miners WeeklyPay ETF [GDXW]

GDXW had total dividends of $3.6797 from 10/30/2025 to 12/23/2025. It has been active for 1.76 months. During that time frame it had a starting price of $51.71, a high price of $63.00, a low price of $47.68, and a 12/23/2025 price of $62.40. This means that it had a yield of 7.12%, or an average monthly yield of 4.05%. The peak-to-valley is -24.32%.* The capital gains were 20.67%. The overall gain/loss (cap gains + yield) is 27.79%, or a gain/loss per month of 15.82%. The average volume since inception was 29,342.

GDXW received a recent dividend of $0.6507 on 12/23/2025. This means the current yield ($0.6507 / $62.40 * weeks/months per year paid) is 54.23%.

*For an explanation of how Dividend Farmer calculates “peak-to-valley,” please see the FAQ.