TRANSPORTATION -- An Analysis of the Top 25 Transportation Sector Dividend Payers 2/1/2024 to 1/31/2025

The top 25 Transportation Sector dividend payers ranked by yield

As always, please read our disclaimer.

**NEW — Get this single post for a one-time fee of $5

The following stocks are sorted in descending order of greatest “yield.”

Please note some of these may have had “special” dividends or spinoff payments which will not repeat.

All dividends are calculated based on the “Ex-EFF Date.”

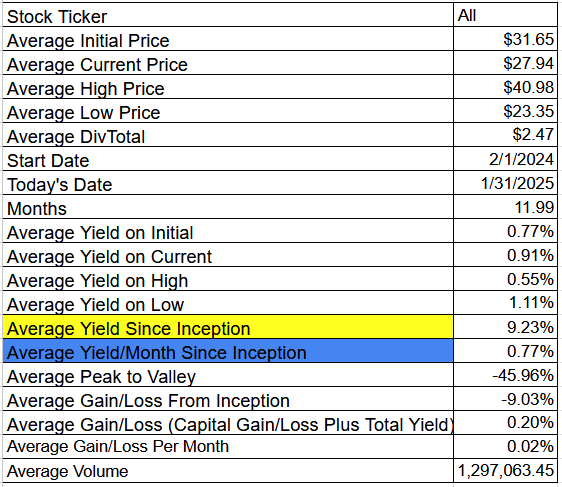

Here’s a “table of averages” for the 25 issues below; not definitive, but kind of interesting.

[1] ZIM Integrated Shipping Service [ZIM]

ZIM had total dividends of $4.8100 from 2/1/2024 to 1/31/2025. During that time frame it had a starting price of $13.26, a high price of $30.15, a low price of $9.08, and a 1/31/2025 price of $17.80. This means that it had a yield of 36.27%, or an average monthly yield of 3.03%. The peak-to-valley is -69.88%. The capital gains were 34.24%. The overall gain/loss (cap gains + yield) is 70.51%, or a gain/loss per month of 5.88%. The average volume from 2/1/2024 to 1/31/2025 was 5,698,998.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/ZIM/dividend-history

[2] TORM plc [TRMD]

TRMD had total dividends of $5.8600 from 2/1/2024 to 1/31/2025. During that time frame it had a starting price of $34.91, a high price of $40.47, a low price of $17.77, and a 1/31/2025 price of $19.93. This means that it had a yield of 16.79%, or an average monthly yield of 1.40%. The peak-to-valley is -56.09%. The capital gains were -42.91%. The overall gain/loss (cap gains + yield) is -26.12%, or a gain/loss per month of -2.18%. The average volume from 2/1/2024 to 1/31/2025 was 885,159.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/TRMD/dividend-history

[3] Star Bulk Carriers Corp. [SBLK]

SBLK had total dividends of $2.5000 from 2/1/2024 to 1/31/2025. During that time frame it had a starting price of $21.42, a high price of $27.47, a low price of $14.30, and a 1/31/2025 price of $15.37. This means that it had a yield of 11.67%, or an average monthly yield of 0.97%. The peak-to-valley is -47.94%. The capital gains were -28.24%. The overall gain/loss (cap gains + yield) is -16.57%, or a gain/loss per month of -1.38%. The average volume from 2/1/2024 to 1/31/2025 was 1,730,024.

For further information, please see the following link:

https://www.nasdaq.com/market-activity/etf/SBLK/dividend-history