SIMPLIFY -- An Analysis of Simplify's Dividend Payers since inception through 11/14/2025

Simplify has a mix of high dividend payers and interesting capital gains

As always, please read our disclaimer.

Simplify is kind of an interesting company. They manage $11.59 billion across all of their funds, making them the equivalent of a cottage-industry-player — when compared to titans like Black Rock ($10.4 trillion, Vanguard ($9.3 trillion) and Fidelity ($5.3 trillion).

That said, Simplify has a very broad product mix of ETFs, many of which pay dividends.

They offer everything from bond funds to Bitcoin; and a commodity fund to a China fund — and pretty much everything else in between.

You could literally manage an entire really well diversified portfolio and never leave the Simplify universe of funds.

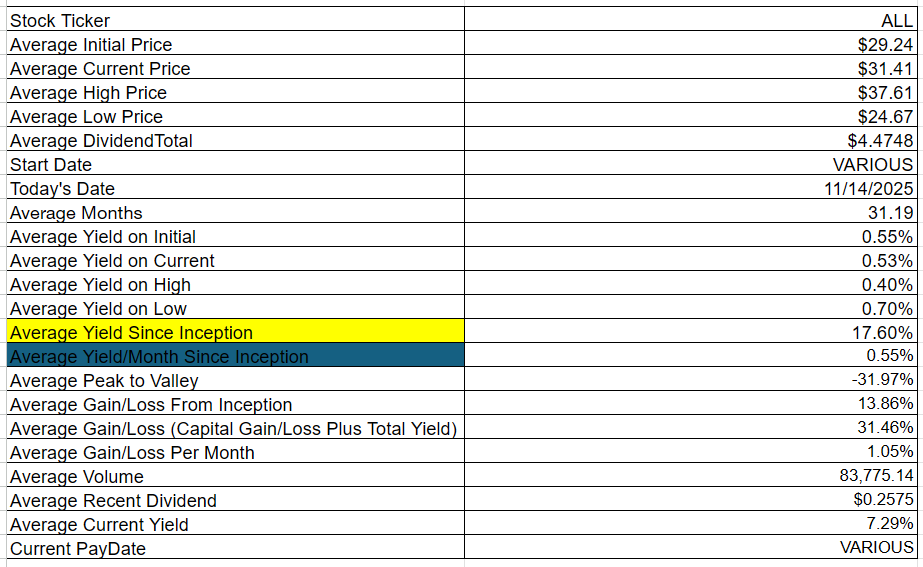

When you normalize all of Simplify’s products by month, you end up with the following averages.

A 17.60% average yield (0.55%/month), a 13.86% average capital gain, and a total yield + capital gain average of 31.46%, or about 1.05% per month when normalized by the average number of months (31.19).

That doesn’t seem like much when stacked up against things like Roundhill’s HOOW, or YieldMax’s HOOY — which have been doing 12%+ on a per month basis of late — but Simplify is one of those companies that seems to rely on “doing a good job” instead of “putting jet fuel in the car gas tank and watching what happens when you floor it.”

A lot of the stuff we cover here at Dividend Farmer isn’t for everyone — but Simplify certainly does have pretty much everything you could ever want in terms of investments, risk profiles, and etc. — all under one roof.

And that they’re holding $11.59 billion in Assets Under Management, well, that kind of says it all. People (and investment advisors) have voted with their money.

The average months here are 31.19 across all products.

Average current yield (most recent payment / current stock price * number of periods per year paid) is 7.29% across all of their products — which when you compare that to some of the Big Dogs:

is right in the ballpark (and often better) than what the Big Dogs have on offer.

That average current yield is anchored by MAXI (63.59% current yield) but when you toss that out and average the rest, you still get a healthy 5.68% — competitive with Big Dogs-type yields — and that includes in that average some Simplify products which have hardly any yield at all.

Simplify is a bit difficult to cover because its dividend payers have such a wide range of goals and performance metrics.

But this is Dividend Farmer — so we’ve ranked everything like we usually do — descending yield + capital gain.

That gives you a pretty good overview of how everything has performed over time — which then allows you to take a look at yields, then current yields to get a better sense of what you are getting into with each product.

Highest flier here in terms of average monthly yield? MAXI (#2) at 4.31% yield per month.

If you are looking for a huge variety of strategies, yields, and capital gain performance metrics, Simplify’s product lineup ought to keep you occupied for a while.

You can read more about the strategies behind each product here:

Enjoy!

The following stocks are sorted in descending order of greatest “yield per month.”

Please note some of these may have had “special” dividends or spinoff payments which will not repeat.

All dividends are calculated based on the “Ex-EFF Date.”

[1] Simplify Gold Strategy Plus Income ETF [YGLD]

YGLD had total dividends of $1.6500 from 12/3/2024 to 11/14/2025. It has been active for 11.36 months. During that time frame it had a starting price of $25.00, a high price of $48.61, a low price of $23.30, and a 11/14/2025 price of $43.47. This means that it had a yield of 6.60%, or an average monthly yield of 0.58%. The peak-to-valley is -52.07%. The capital gains were 73.88%. The overall gain/loss (cap gains + yield) is 80.48%, or a gain/loss per month of 7.08%. The average volume since inception was 17,439.

YGLD received a recent dividend of $1.0000 on 9/30/2025. This means the current yield ($1.0000 / $43.47 * weeks/months per year paid) is 9.20%.