GLOBAL X -- An Analysis of GLOBAL X's Top 25 Dividend Payers from 11/1/2024 to 10/31/2025

Global X's top 25 dividend payers from 11/1/2024 to 10/31/2025 ranked by yield

As always, please read our disclaimer.

While GlobalX has a total of 88 dividend payers, we’ve only covered the top 25 here.

After the top 25 by yield things fall off quite a bit, all the way down to GNOM with a sub 1% yield over the past year (not included below).

That said, there is some interesting stuff here, with BITS (#1) leading the pack in terms of yield, BKCH (#22) leading the pack in terms of yield + capital gain, and most yield + capital gains numbers averaging out to about 12% over the past year if you take out the high fliers.

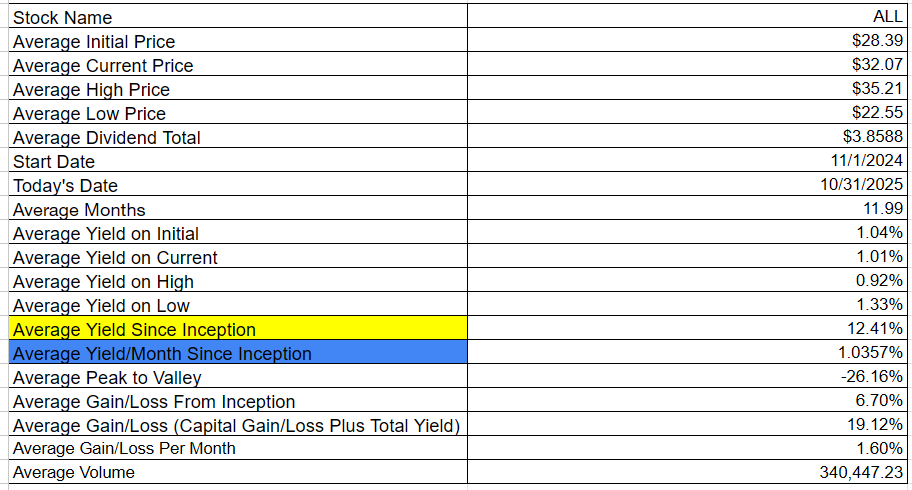

Overall, GlobalX products, when taken in the aggregate, are fairly stable, anchored by a couple of higher cap-gains performers, but still with an overall average yield of 12.41% and average capital gains of 6.70% (see averages table below).

That said, 15 of the 25 here had negative capital gains, though with yield added in, only one was negative. While that does indicate a bit of NAV erosion, yields are cancelling out that NAV erosion quite handily (and consistently).

Only QYLD is heavily traded here (6 million shares average daily volume), with 9 of 25 having volumes of less than 10k, 20 less than 100k, and only 3 breaking the 500k mark (including QYLD). So these products are mostly well off the beaten path in terms of notoriety.

A few things definitely worth taking a look at here, depending on whether you are aiming for yield, or yield + capital gain.

The following stocks are sorted in descending order of greatest “yield per month.”

Please note some of these may have had “special” dividends or spinoff payments which will not repeat.

All dividends are calculated based on the “Ex-EFF Date.”

Here’s a “table of averages” for the issues below; not definitive, but kind of interesting.

[1] Global X Blockchain & Bitcoin Strategy ETF [BITS]

BITS had total dividends of $19.5923 from 11/1/2024 to 10/31/2025. During that time frame it had a starting price of $70.55, a high price of $118.78, a low price of $45.63, and a 10/31/2025 price of $107.70. This means that it had a yield of 27.77%, or an average monthly yield of 2.32%. The peak-to-valley is -61.58%. The capital gains were 52.66%. The overall gain/loss (cap gains + yield) is 80.43%, or a gain/loss per month of 6.71%. The average volume since inception was 5,931.