GIAX and FIAX -- Two Funds from Xfunds by Nicholas Wealth

A comparison of two relatively new dividend-bearing ETFs

As always, please read our disclaimer.

This post answers a question from a redditor about GIAX.

All dividends are calculated based on the “Ex-EFF Date.”

Someone asked for a digest on GIAX -- a dividend bearing ETF from Nicholas Wealth Xfunds (https://nicholasx.com/giax/), so here you go.

Here is a ChatGPT summary of the fund information on the GIAX information page:

The Nicholas Global Equity and Income ETF (GIAX) seeks income and capital appreciation by holding global equity ETFs, U.S. Treasury securities, and selling index call spreads on U.S. indices. It pays monthly dividends, with potential extras from options performance.

And here is the analysis:

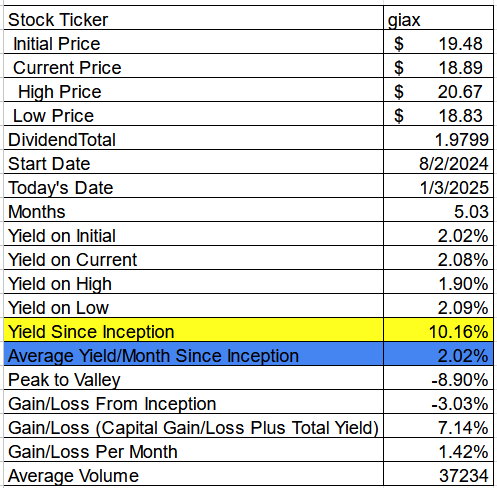

Where you've got your initial price (8/2/2024), current price (1/3/2025), high, and low prices, and your dividend total.

And following that are the various yields if you'd bought GIAX today (current price), or at the high, low, or way back on Aug 2, 2024 (initial price).

This is way more realistic because it gives you a feel for what's actually happening right now -- or at least in the not-to-far-distant past (the preceding year, not just the past month).

Which means actual yield is somewhere in the range between 1.90% per month, and 2.09% per month, depending on where you bought GIAX.

Total yield since inception is in yellow — 10.16% -- which gives you an average yield per month of 2.02%

Add in the cap gains since Jan 1, 2024 (-3.03%) and you've got a total of 7.14% (cap gains + yield) since inception or about 1.42% per month. Which is pretty competitive.

GIAX is a little short on performance history here but seems to be moving in the right direction.

Xfunds also has another fund FIAX -- which has been around for a bit longer.

Here's the 40 word ChatGPT summary of that fund from https://nicholasx.com/fiax/

The Nicholas Fixed Income Alternative ETF (FIAX) seeks income through U.S. Treasury securities and a defined risk option premium strategy using vertical credit and debit spreads. It pays monthly dividends, with potential extras from options performance.

And here's the analysis:

So same deal as the table above: initial (12/2/2022) price, current price (1/3/2025) and the high and low.

Then the number of months, followed by yields depending where you bought it.

Total yield over the time period (yellow) and average yield per month (blue).

So here while the Yield Since Inception is higher, there are more months to divide it by -- leaving an average yield per month of 0.50%. Add in the capital loss (-5.05%) and you end up with an overall cap gains + loss of 7.40% over those 25.03 months, or an average gain/loss per month of 0.30%.

So GIAX is definitely the better choice here in terms of yields, at least for now, but no one can tell the future!